General

The laundering of illicit/illegally generated funds occurs by disguising the source and the ownership of the proceeds, changing the form, or moving the funds to a place where they are less likely to attract attention. This process deceives the authorities and escapes their scrutiny, including efforts to interdict and seize such funds. A key way in which this deception is accomplished is by also deceiving the banks and other financial institutions into dealing with the funds without triggering their obligation to report to the authorities.

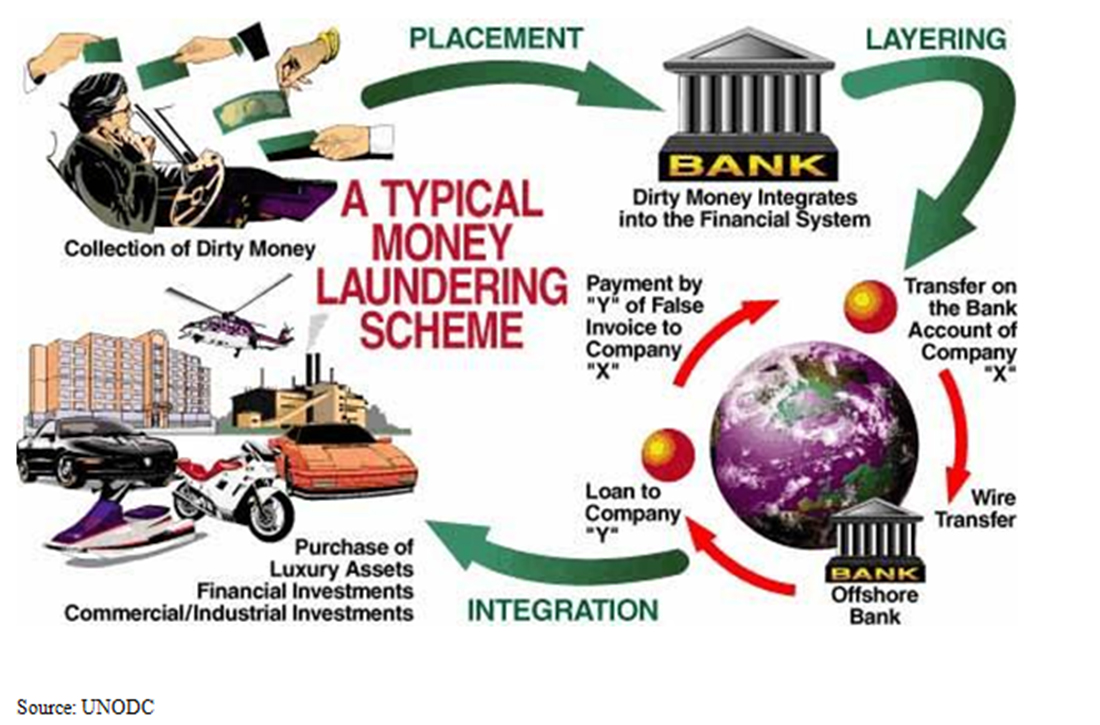

Money can be laundered by many methods, which vary in complexity and sophistication. But the traditional cycle is broken into three steps:

-

Placement: this is where illegal/illegitimate funds are gathered and placed into the financial system, for example deposited into a bank account. For a financial institution, rigorous Onboarding Process including Client Due Diligence process and Know Your Customer procedures, mitigates the risk that illegal/illicit funds are placed into that institution.

-

Layering: to disguise the origin of the funds, including foiling any pursuit of such funds (say by investigators), the funds maybe moved in a variety of ways within the financial system (wire transfers, fictitious business deals, false invoicing etc.) to make the funds appear as if they are proceeds from legitimate activity. Transaction surveillance/monitoring and investigations at a financial institution are aimed at detecting this layering activity. Since financial institutions are interconnected, some globally, they are subject to the risks of laundered proceeds entering into their individual systems from a variety of jurisdictions with different regulatory and enforcement cultures.

-

Integration: the funds then get extracted (such as by purchase of assets, through investments etc.) for ostensibly legitimate use without the fear of authorities because the illicit/illegal origin of the funds were disguised in the Layering phase

Transnational Money Laundering

Transnational money laundering spans the entire globe. In this lucrative venture, professional money launderers form formal or loose affiliations forming organizations and networks. Professional Money Laundering Report, published by FATF on 26, July 2018 (FATF PML Report) discusses in detail the operational specifics utilized by professional money launders, including their scope, organizational capacity, sophistication of their strategies and their responsiveness to counter-strategize any enhancement in regulatory and enforcement capacity. The FATF PML Report categorizes professional money launders into the following:

- Individual Professional Money Launderer (PML): possesses specialized skills or expertise in placing, moving and laundering funds, while also performing a legitimate, professional occupation such as offering accounting services, financial or legal advice, and the formation of companies and legal arrangements.

- Professional money laundering organization (PMLO): consists of two or more individuals acting as an autonomous, structured group that specializes in providing services or advice to launder money for criminals or other Organized Criminal Groups. Laundering funds may be the core activity of the organization, but not necessarily the only activity as the individual constituents of the PMLO may engage in legitimate activities.

- Professional money laundering network (PMLN): is a collection of associates or contacts working together to facilitate PML schemes and/or subcontract their services for specific tasks. These networks usually operate globally, and can include two or more PMLOs that work together. These extensive PML networks are able to satisfy the demands of the client by opening foreign bank accounts, establishing or buying foreign companies and using the existing infrastructure that is controlled by other PMLs. Collaboration between different PMLs also diversifies the channels through which illicit proceeds may pass, thereby reducing the risk of detection and seizure